Investment Details

Investment Breakdown

Investment Details

Investment Breakdown

Welcome to the InvestLogical Financial Calculators page! Use our calculators to plan for your future, make informed financial decisions, and track your financial goals. Whether you’re planning for retirement, investing through SIPs, or determining your insurance needs, our calculators provide clear and actionable insights to help you achieve financial security.

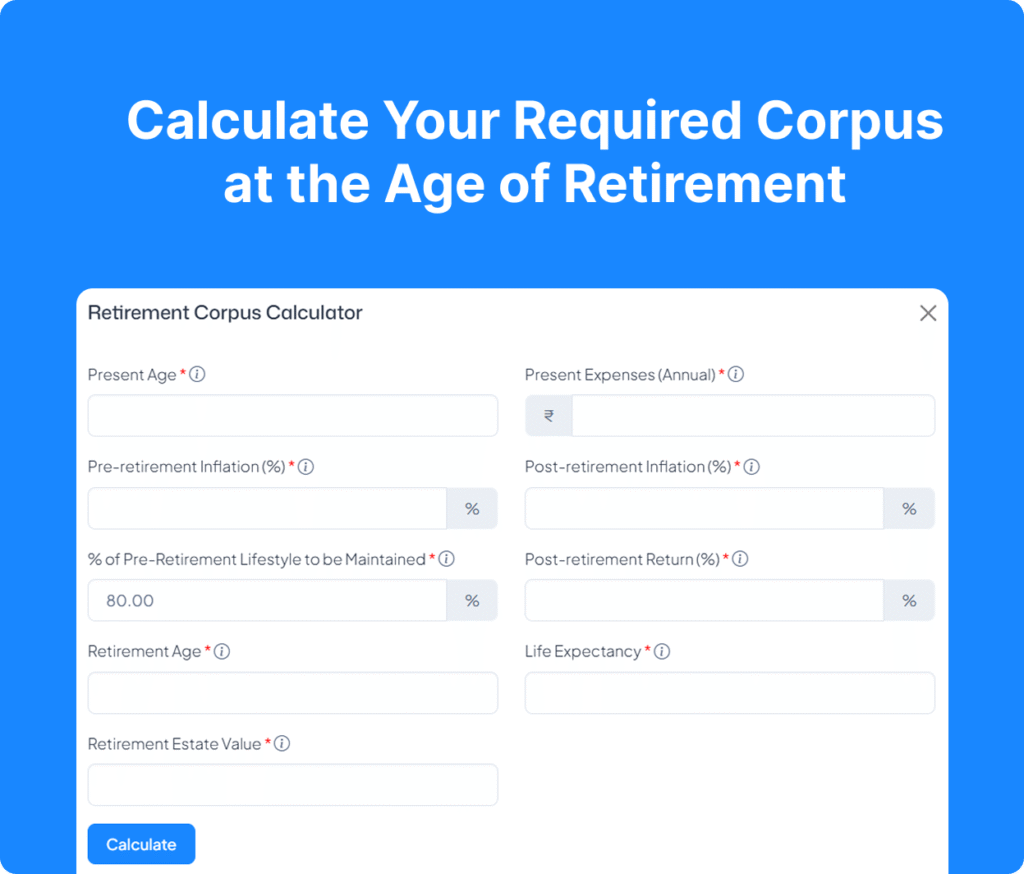

Retirement Planning Calculator

Planning for a secure and comfortable retirement starts with understanding how much money you will need when the time comes. Our Retirement Planning Calculator helps you estimate the total amount of savings you will need to maintain your desired lifestyle after retirement.

Enter your current age, expected retirement age, monthly expenses, inflation rate, and expected return rate on investments. The calculator will then estimate the required corpus you need to accumulate by the time you retire.

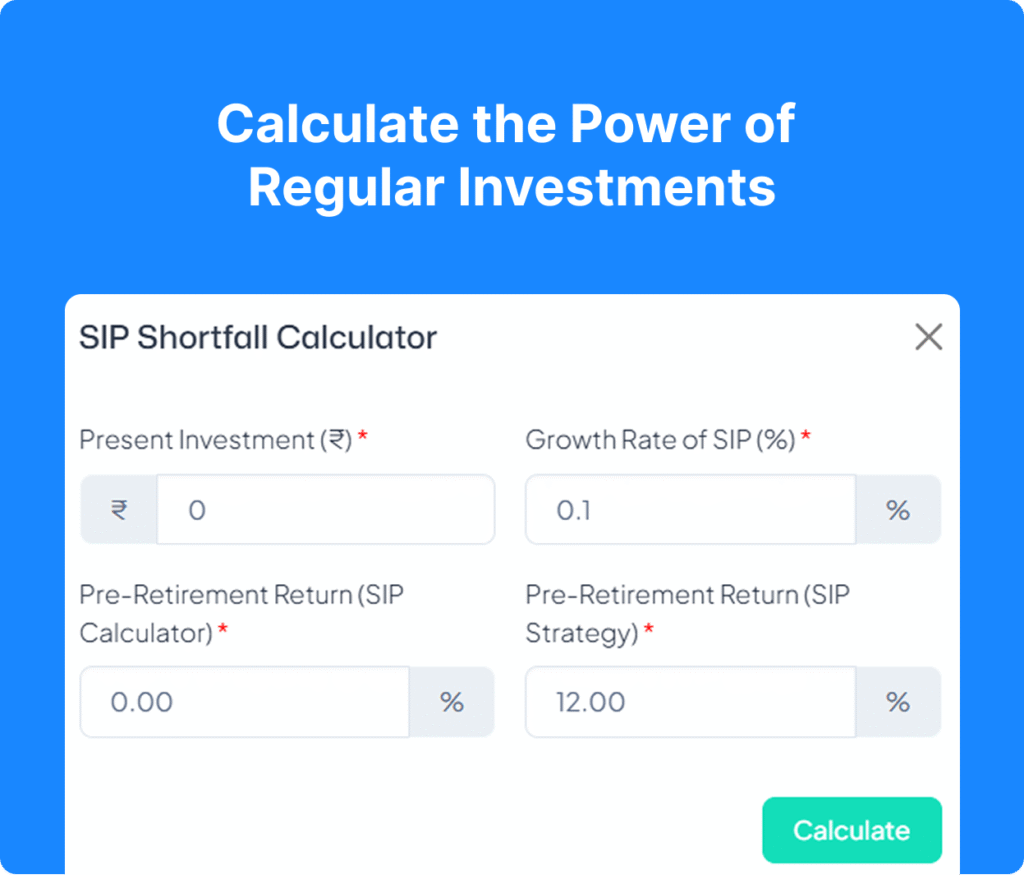

SIP (Systematic Investment Plan) Calculator

An SIP is a smart way to invest regularly in mutual funds, allowing you to grow your wealth over time while averaging the market risks. Our SIP Calculator helps you estimate the amount of money you can accumulate over a given time by investing a fixed amount regularly.

Enter your investment amount, expected rate of return, and investment duration. The calculator will show you the future value of your investment and how much you will accumulate by the end of the investment period.

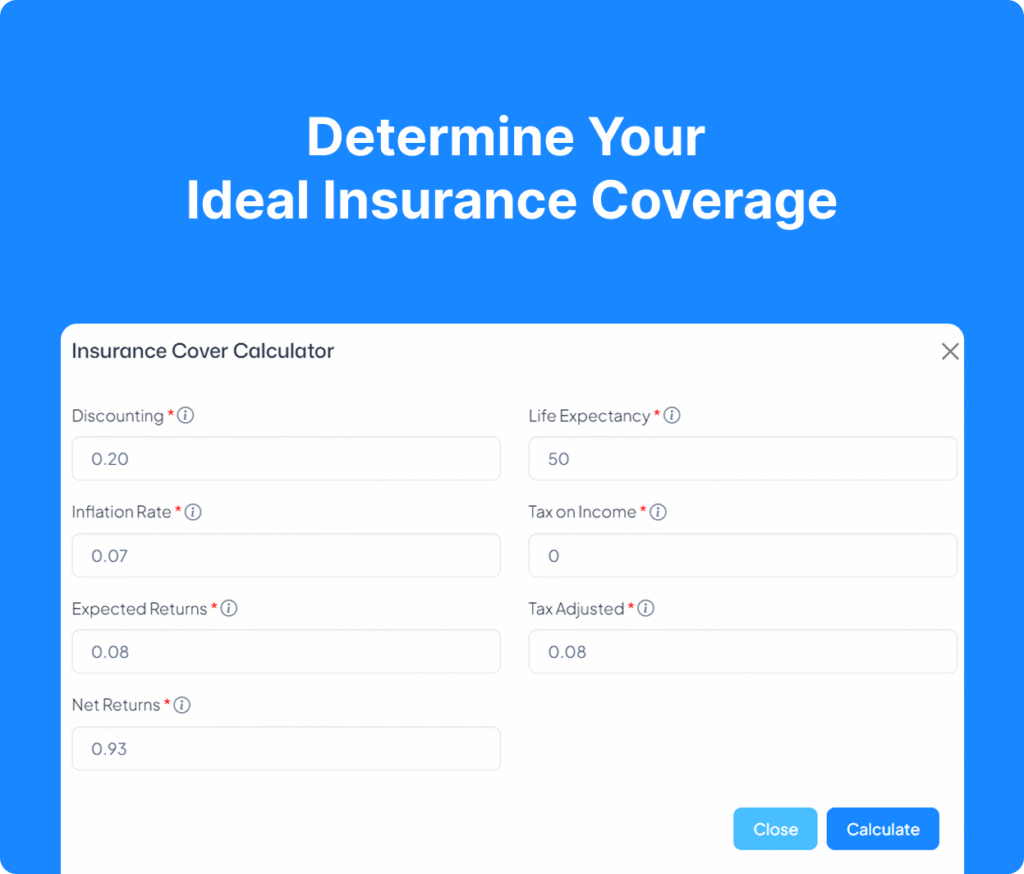

Insurance Calculator

Life insurance is a crucial component of financial planning that ensures your family is financially secure in case of unforeseen circumstances. Our Insurance Calculator helps you calculate the amount of life insurance coverage you need based on your income, dependents, and existing liabilities.

Enter your details, such as age, income, number of dependents, liabilities, and desired coverage factor. The calculator will then recommend an ideal coverage amount to ensure your family is financially protected.